News ———— Memo

The debt is due

Suppose 2020 will be remembered as the year of post-over-a-decade-of-quantitative-easing with Covid-19 as the finale where global central banks simultaneously did their best to inflate financial markets with trillions and trillions of dollars, calling it “helping the economy recover”. In that case, 2021 will be remembered as the year when financial markets became a meme.

by Anna Svahn —

Inflation has become a much more messy concept than it used to be; which is the reason I dedicated an entire memo to revisit the definition once and for all. If you are not familiar with the original definition and its evolution over time, I recommend reading it first.

We began last year with an attack on the hedge fund Melvin Capital, which held a short position in Game Stop, led by Keith Gill, also known as Roaring Kitty on Reddit. Roaring Kitty and his followers targeted Game Stop because more than 100 percent of the public float had been sold short, leading them to think they could squeeze Melvin Capital out of their short position. In less than a month, the group of retail investors from Reddit had squeezed the price from around 17 USD to 347 USD, more than +1 900 percent, and Melvin Capital’s performance declined 53 percent in the year’s first month as a result of the short squeeze.

The year then continued with the Archego implosion, heavy institutional inflow of capital and investments in the maturing crypto market, shaky Chinese markets and defaulting real estate giants, and now, a global energy crisis with exploding energy prices. But most importantly, the consumer price index started to rise. Fast.

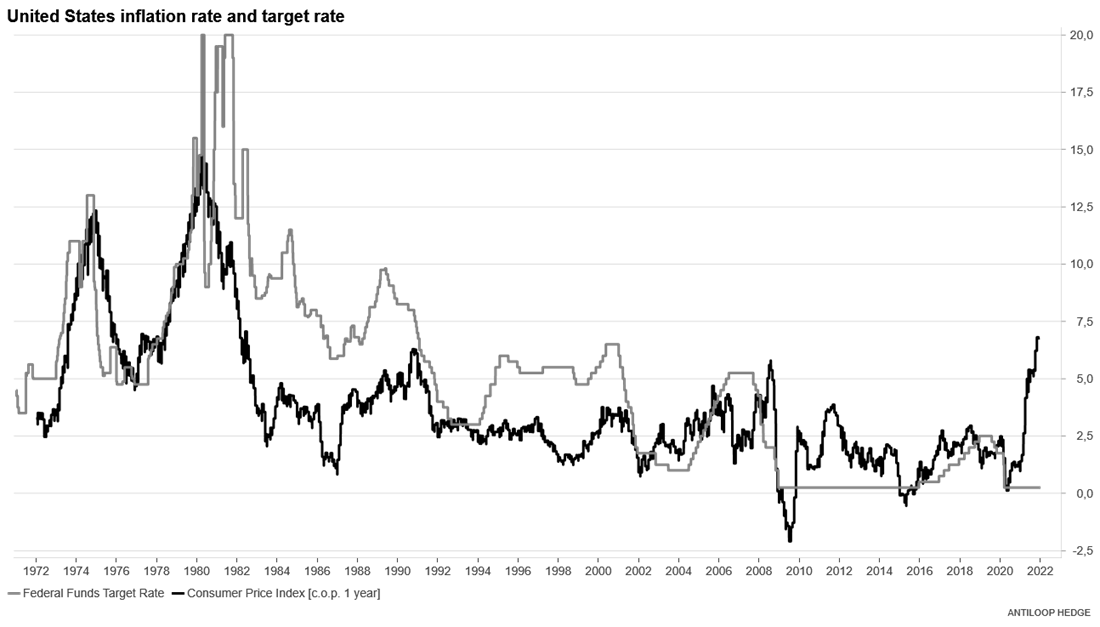

Most of us had expected CPI to catch up sooner or later, but some did not see that coming at all. The Federal Reserve was caught by surprise by higher than expected inflation, month after month. First, they called it transitory. Later, they said inflation might run higher for longer than they expected, and now, they start to realize that rising prices are here to stay.

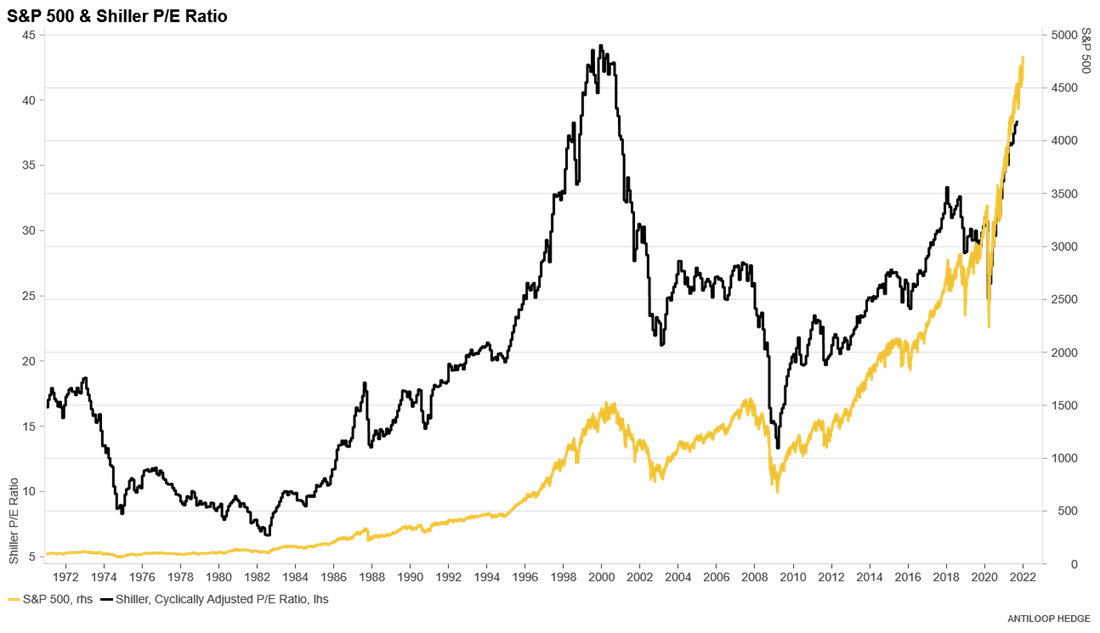

Prices are not the only things running high. As inflation has been catching up, so has asset prices. The S&P 500 closed at record levels on 69 days in 2021, the most all-time highs in 26 years. As central banks have poured money into the financial system, valuations have stretched to levels close to the IT-mania 20 years ago. This, however, seems not to bother the new generation of investors educated by threads on Reddit, as it is different this time. No need to worry, in other words.

Although the last year has shown us that we should be careful making investment decisions only based on valuations, an expensive company can always get pricier. Ironically, it was Keynes, the father of QE, who said that markets can stay irrational longer than you can stay solvent.

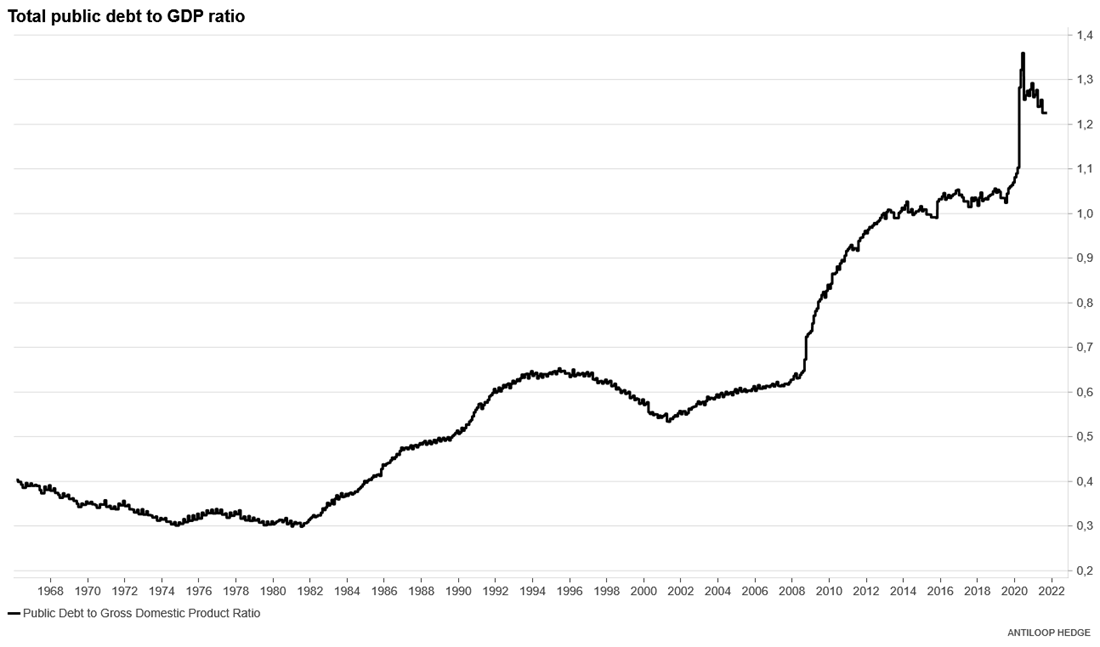

But, as I wrote earlier, valuation multiples have not been the only thing going up during the last year. After bottoming in May 2020 at a 0.11 percent annual rate, consumer price inflation quickly rose to almost 7 percent at the end of 2021. With rates close to zero, the Federal Reserve has argued it can use higher rates as a tool to fight inflation. But how high can rates go with debt piled up to record levels? And could the debt itself actually be what becomes the remedy to rising inflation?

We often hear central bankers talk about rising interest rates as a tool to fight inflation, but that is not entirely true.

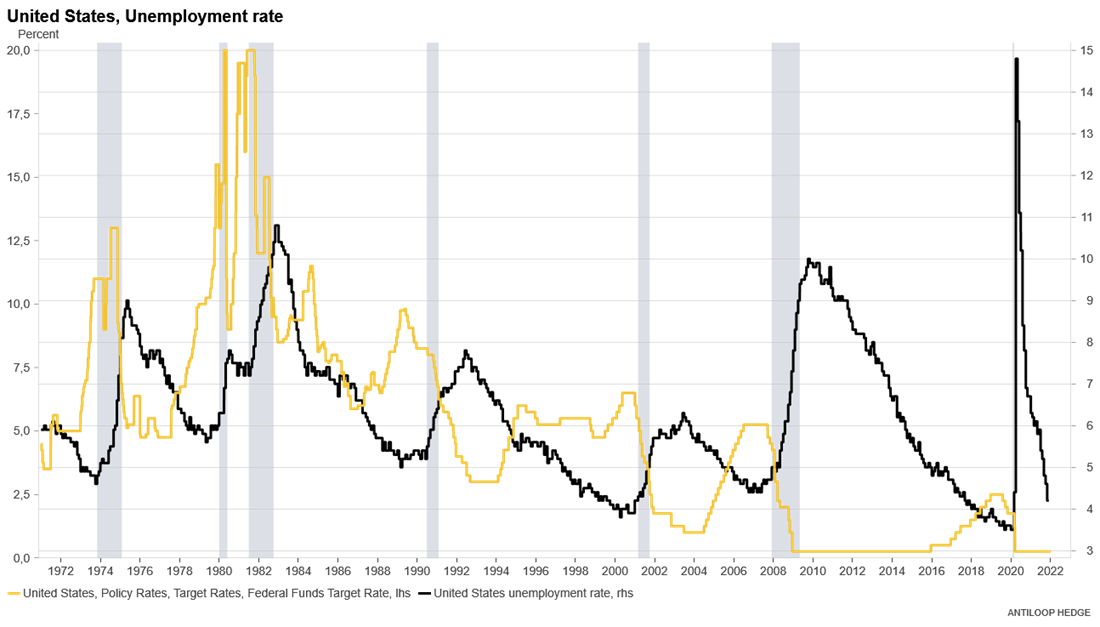

When the US raised rates at the beginning of the ’70s to fight inflation, consumer prices kept on rising. And, when the inflation rate actually fell between 1974-1976, it had little to do with over 10 percent rates and more to do with the recession the country found itself in. With unemployment climbing from under 5 to over 9 percent in a little over a year, the central bank had to lower the target rate again to help the economy recover.

When Paul Volcker 40 years later was asked about how he handled the situation by raising the target rate to 20 percent, he said that inflation is more psychological than anything else, meaning that even if rising rates can be used as a tool to fight inflation, in the end, it’s not the higher interest rates that will keep consumer prices down, but the people’s expectations of inflation that will.

That could also explain why it took many years, and rates went from 5 to 15 and then to 20 percent before inflation fell (however, note that while inflation fell, the rate of rising prices never went negative and became deflationary).

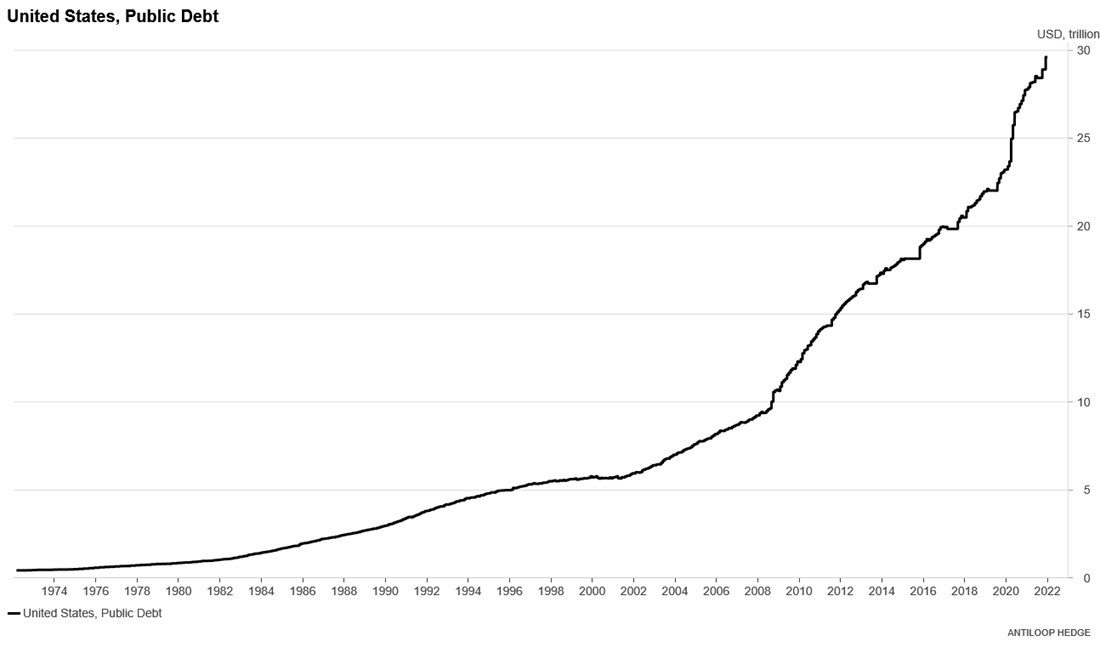

Since Volcker’s heroic act in 1980, the overall trend for both unemployment and what we could call a “normalized” target rate has been going down. All while the debt has been piling up to close to 30 trillion USD, or from 30 percent of GDP in 1980, to over 120 percent of GDP today. We are drowning in debt.

2022: Time to pay our debts

2022: Time to pay our debts

The time has come to pay our debts. When the Fed released their minutes from the last FOMC meeting, signaling that rate hikes might come sooner than first anticipated, the market reaction was as immediate as it was negative. The tech-heavy Nasdaq index fell just a little over 3 percent, making investors hope for a different response from the Federal Reserve.

The Federal Reserve’s dual mandate from Congress is to keep prices stable and maximize employment. Historically, when the Fed has been torn between the two objectives, it has prioritized the latter. The question now is, with employers adding more workers more rapidly than Fed officials believed they would, will this be the time to chase normalization of the target rate?

I mentioned earlier that one plausible scenario could be that the debt itself becomes the answer to the Federal Reserve’s prayers. Instead of looking at low rates and high debt as an issue when fighting inflation, it could be seen as the solution. With debt at record levels and high inflation, there is little room for costs to go up even further, meaning just a few smaller rate hikes could slow down inflation.

However, of course, more factors are playing into this scenario. If wages caught up, slightly higher rates wouldn’t matter as much, and we could be facing a scenario similar to that of the ‘70s, with rates chasing rising consumer prices until the labor market reacts on the downside and the Federal Reserve has to answer by lowering rates or with more economic stimulus again. It is, in other words, not an easy position to be in for the Federal Reserve.

How financial markets will behave this year is clearly up to Powell. Still, I think that after a decade of being outdated, value investing will finally find its way back into investors' hearts, while tech and growth stocks will enter a highly volatile era. Another winner will with no doubt be the energy sector, and metals used to ramp up the energy transition.

And the inflation? Well, I believe the last decade has set a snowball in motion, which will be more complicated to stop than anticipated and that the biggest losers, in the end, will be those who hold the bag with USD.