News ———— Memo

Inflation or deflation: yes

Mark Twain’s quote, “History does not repeat itself but it often rhymes” has been used more than once to compare different economic cycles. First, asset prices soar, leading investors to believe that we have entered a new market paradigm. That fundamentals no longer matter and what the future holds will make up for the high prices that we are paying today.

by Anna Svahn —

Mark Twain’s quote, “History does not repeat itself but it often rhymes” has been used more than once to compare different economic cycles. First, asset prices soar, leading investors to believe that we have entered a new market paradigm. That fundamentals no longer matter and what the future holds will make up for the high prices that we are paying today.

After a while, reality taps on the shoulder of the market, leaving many nursing losses as they watch their portfolio shrink in size as assets and stocks, in particular, decrease in value. Investors and fund managers that have lived through and sometimes thrived during several market cycles have always been able to lean against the concepts of fundamentals and value investing instead of being driven by greed.

But what happens when the rules of fundamental analysis get rewritten? And what is different this time if we compare it to the tech bubble and the financial crisis? Superficially, it is easy to compare the current market with the situation at the beginning of this millennium. Multiples have expanded in a somewhat similar way, and it is easy to believe that this is indeed at least a similar phenomenon. However, there is a big difference between multiple expansion and what we see today: multiple inflation.

Baburu Keiki

Imagine a decade or more from now, when we read about the financial market during and after the pandemic, and how the central banks’ attempt to artificially create a V-recovery for the economy only resulted in inflated asset prices, it would say something like this:

The bubble was characterized by a rapid acceleration of asset prices, overheated economic activity, and uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy.

Again, history does not repeat itself, but it often rhymes. Baburu Keiki is Japanese for “bubble economy”. The description above was used to tell the story of what went wrong with the Japanese Economy from 1986 to 1991 when it was no longer possible to postpone risk. What happened then is not far from what we see now; the difference is that we are moving much faster this time.

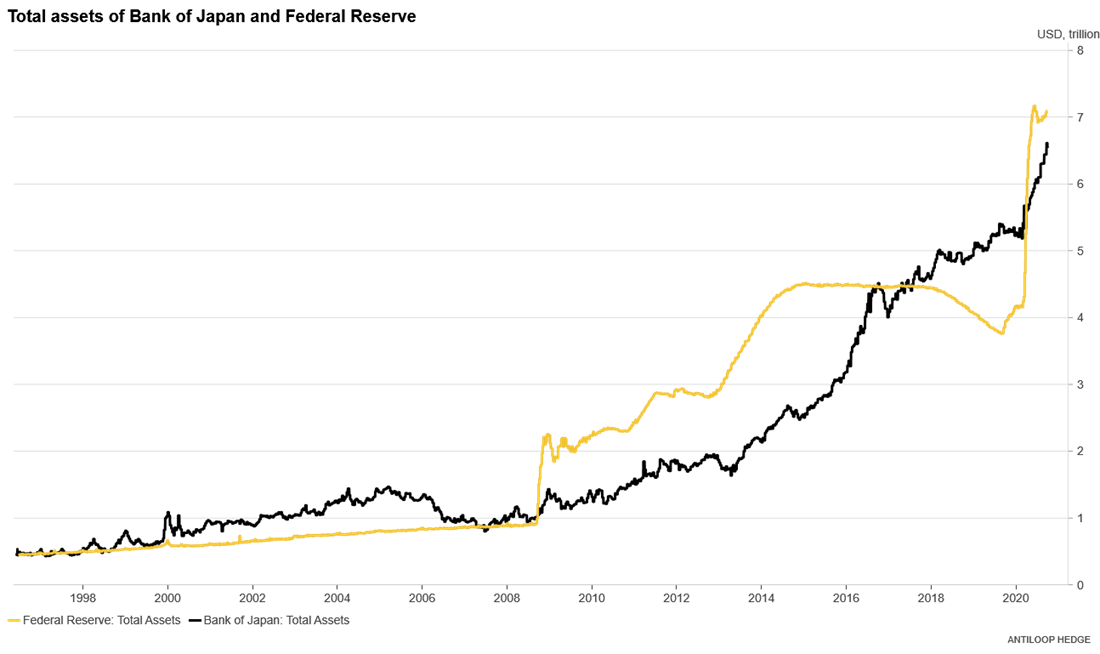

The Federal Reserve went from shrinking its balance sheet in 2018 and the beginning of 2019, to change course on August 2019 and have since then added more than 3 trillion U.S. Dollars, or an expansion of nearly 85 percent, which can be compared to the pace of the Bank of Japan.

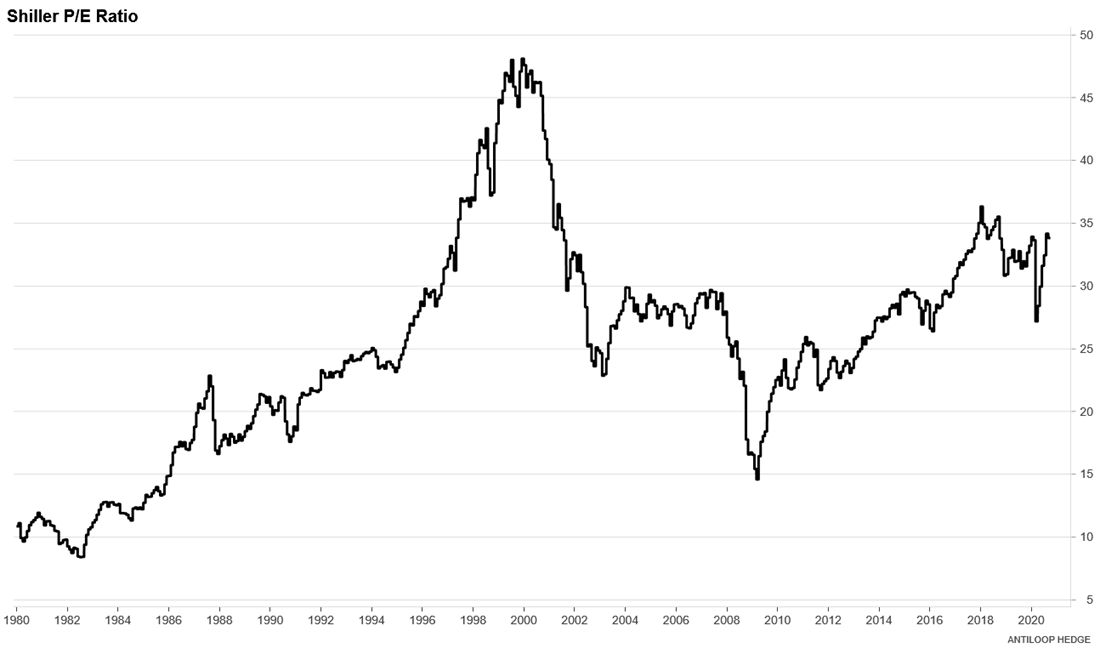

Unlike what many think, we are not witnessing multiple expansions, but multiple inflation. Let me explain the difference by using the Shiller PE Ratio, also known as the cyclically adjusted PE Ratio, in an example:

When multiple expansion occurs, like the one we saw during the tech bubble, the Shiller PE Ratio went from close to its mean of 16 to almost 45. Investors with risk appetite driven by greed allocated capital from other parts of the economy, into the stock market, in particular to tech companies with insignificant earnings, pushing valuations higher until the bubble burst.

An easy analogy would be to compare the economy to a plate filled with water sloshing around from one asset class to another, depending on where the best opportunity to make money seemed to be. The difference now is that we don’t see capital moving around. Instead, this “economy plate” is placed under an open water tap of money conjured out of thin air, making all assets go up in price, which is why I call it multiple inflation instead of multiple expansion. Sometimes "rhyming" actually is different enough from "repeating" to warrant a new strategy.

Inflation with deflation

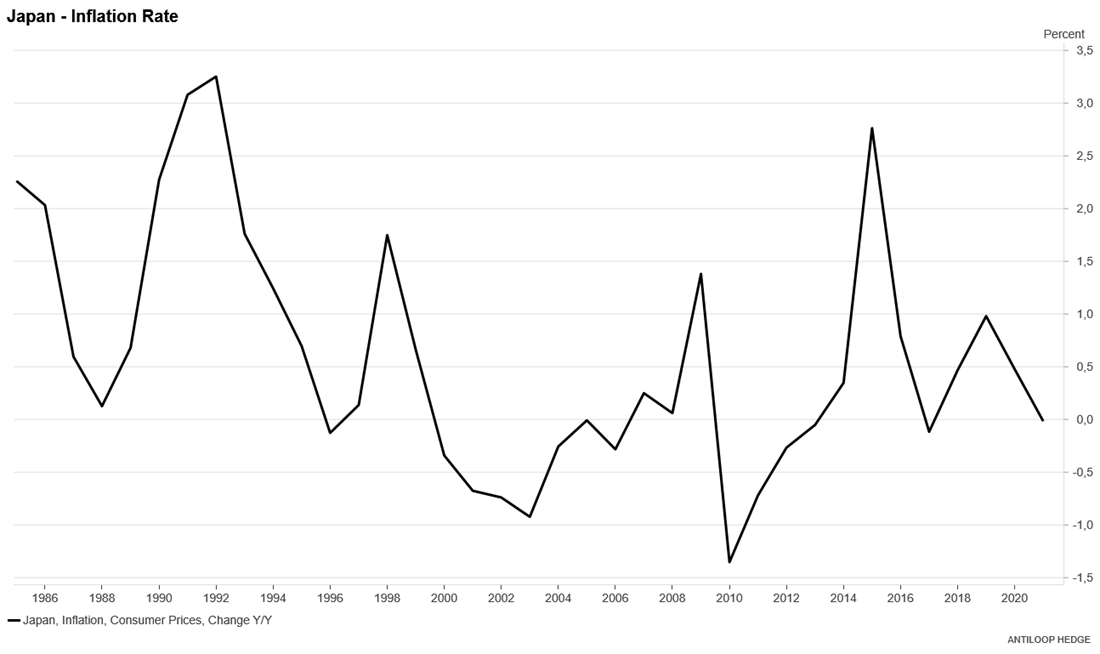

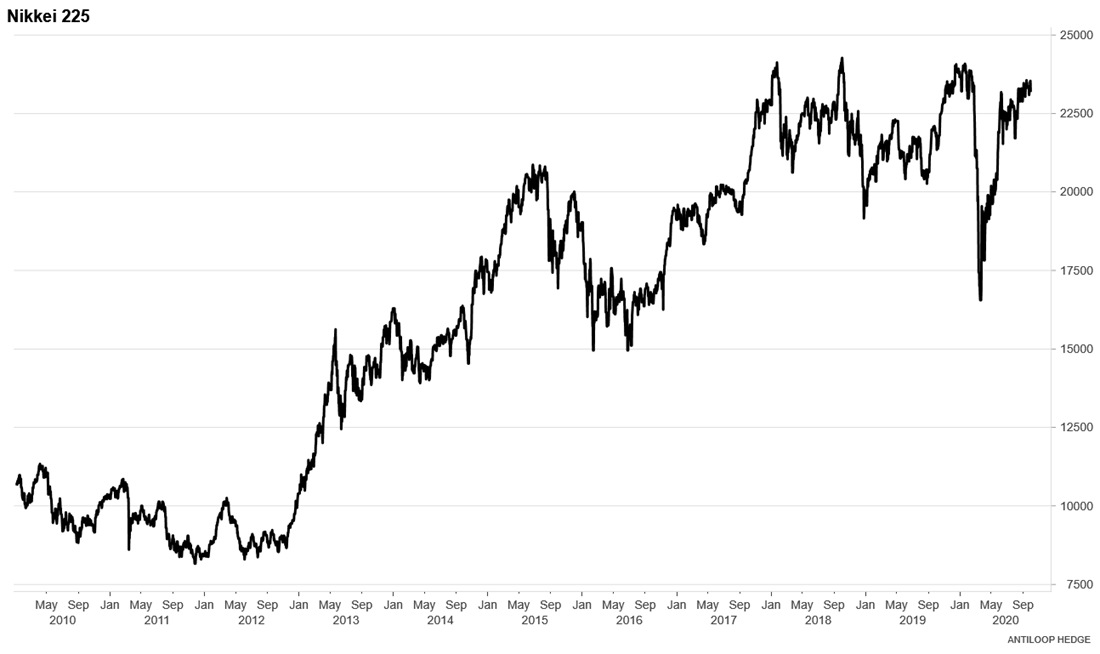

Economists are divided when it comes to drawing any conclusion about the consequences of today’s monetary policy. Printing money should, in theory, lead to consumer price inflation, but as we have seen in Japan, that must not necessarily be the case. Instead, although the Bank of Japan has more than tripled its balance sheet since 2012, the inflation for consumer products rose to just 2,76% as its highest in 2014, only to go back to a deflationary state again in 2016. In the last couple of years, even though Japan has seen massive economic stimulus, inflation has been close to zero. However, in the same period, the NIKKEI 225 has rallied over 160%.

If we were to compare what is happening in the US with Japan’s economy, the conclusion would be that the monetary stimulus will indeed create inflation as expected, i.e., in asset prices, just not in consumer price index (CPI).

At the beginning of the pandemic, I was one of those who thought it would be impossible to see new all-time highs in the markets as we saw the global economy shutting down, leading to a record-high unemployment rate. That is simply not how efficient markets work. However, first of all, markets are not efficient, and second, although we have never seen an economic shut down of this scale before, we have also never seen stimulus packages of this size either.

It is easy to forget that there was a time when liquidity injections were used as a last resort tool for a broken economy. Today monetary stimulus plays an essential role in erasing every threat to new all-time highs on the stock market. China just became a member the asset inflation club in the middle of August by injecting Rmb700m (101 bn USD) as a response to the escalating conflict between China and the US, making China’s CSI 300 index gain 2,4 percent and the Hong Kong’s Hang Seng rose 1,2 percent.

I have shifted from being surprised to imagining probable future scenarios clearer than ever. Asset prices will continue to be inflated. Consumer prices will lag behind leading to central banks reacting with more economic stimuli, trying to force consumer price inflation to go up, which they will eventually do and then at a seemingly unstoppable pace. However, there is more to it. Flooding markets with freshly printed fiat money will create artificial value and make markets more volatile. On top of that, we have another looming problem called liquidity. I hypothesize that in the coming years, timing markets will, in contrast to before, be a much more important tool than time in the market.

Harder, better, faster, stronger

I believe that we will see price cycles that historically have taken markets almost a decade to go through, happen in one or two years. These high-speed cycles will result in stock markets moving sideways over long periods with high volatility, until the global economy has recovered, not only from the pandemic shutdown but also from the monetary stimulus that followed after it.

To add to the problem, we are also facing a liquidity crisis. This is a subject that deserves its own memo, but to summarize the issue, it has to do with the recent years’ massive increase of algorithmic trading. In conjunction with a reduction of the minimum allowed price movement allowed by many exchanges, it has led to a drastic shift in the liquidity of the markets.

Now to the point. Several factors are pointing to what I call harder, (better), faster and stronger markets, meaning they will be more sensitive to all kinds of new data, both positive, but even more so when the news is bad. To handle volatile and sensitive markets you will need a different strategy than the more traditional buy and hold. I believe the best way to create a high risk-adjusted return stream in the future, will be by focusing on low correlated assets using unique, uncorrelated strategies and applying strict risk control, which is exactly what we do at Antiloop Hedge.