News ———— Memo

Another policy failure

First, inflation was too low. Then it was transitory. After that, it was Putin’s fault, but we could at least expect a soft landing. However, after realizing that too would be impossible to achieve while fighting inflation, Powell changed the rhetoric to “Pain is needed.”

by Anna Svahn —

“What the Fed can control is demand; we can’t really affect supply with our policies…so the question whether we can execute a soft landing or not, it may actually depend on factors that we don’t control” - Jerome Powell, May 2022.

First, inflation was too low. Then it was transitory. After that, it was Putin’s fault, but we could at least expect a soft landing. However, after realizing that too would be impossible to achieve while fighting inflation, Powell changed the rhetoric to “Pain is needed.”

Watching Powell channel his inner Volcker is like watching a train derail in slow motion, but in reality, what’s about to crash is the global economy. Central bankers are beginning to panic, and even if it is clear that Powell and many others know that rising rates won’t help to fight supply-driven inflation. The Fed is now under so much pressure that they don’t have any other option than to do so anyway to restore some credibility with the public, even if the U.N. begs the biggest central bank in the world to slow down to avoid a global economic catastrophe.

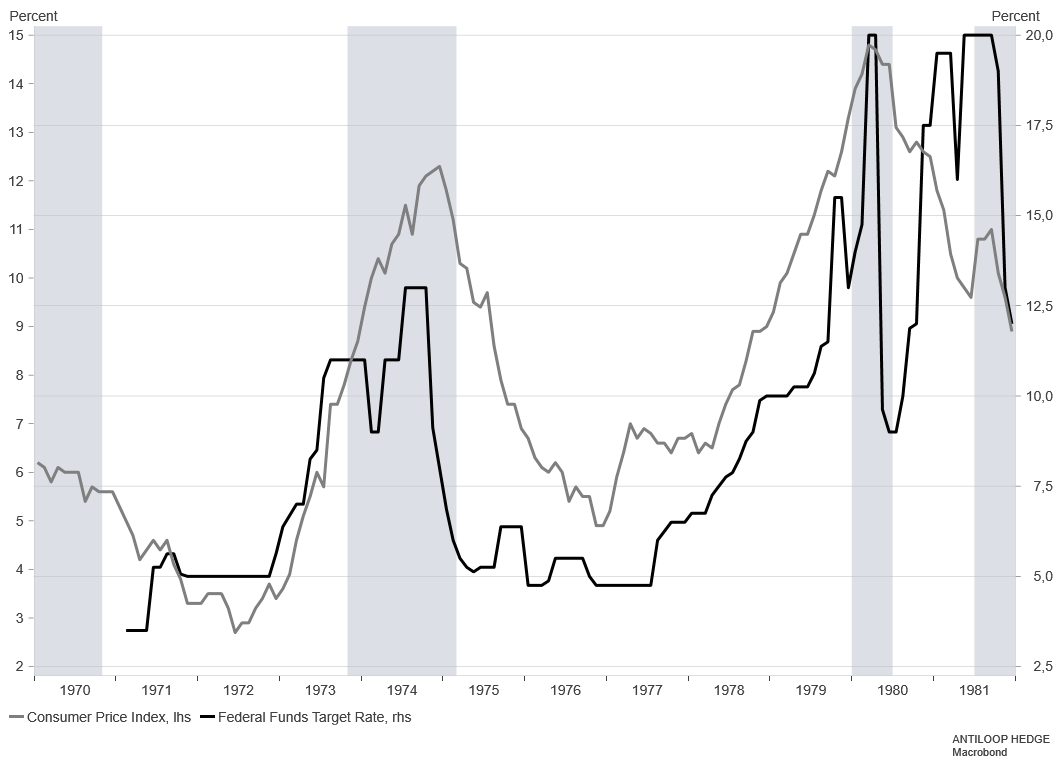

We might witness the first time in history when a central banker learns from someone else’s mistake, only for it to lead to devastating consequences for the economy. When Volcker, in 1973, lowered rates as a response to the economy shrinking and unemployment rising, it eventually led to inflation picking up again a couple of years later, peaking at close to 15 percent before Volcker raised rates to 20 percent. This might have taught Powell that pivoting too early might just prolong the war against inflation.

We might witness the first time in history when a central banker learns from someone else’s mistake, only for it to lead to devastating consequences for the economy. When Volcker, in 1973, lowered rates as a response to the economy shrinking and unemployment rising, it eventually led to inflation picking up again a couple of years later, peaking at close to 15 percent before Volcker raised rates to 20 percent. This might have taught Powell that pivoting too early might just prolong the war against inflation.

State of affairs

State of affairs

There is plenty to unpack when trying to map out the macroeconomic environment. Every time new data comes in, investors are trying to interpret it as good or bad, not for the economy, but for the market. As the Fed has spent the last decade and a half pouring liquidity over financial markets, it has created a backward mentality where good news for the economy creates a sell off in risk-on assets, and bad news results in an opposite reaction.

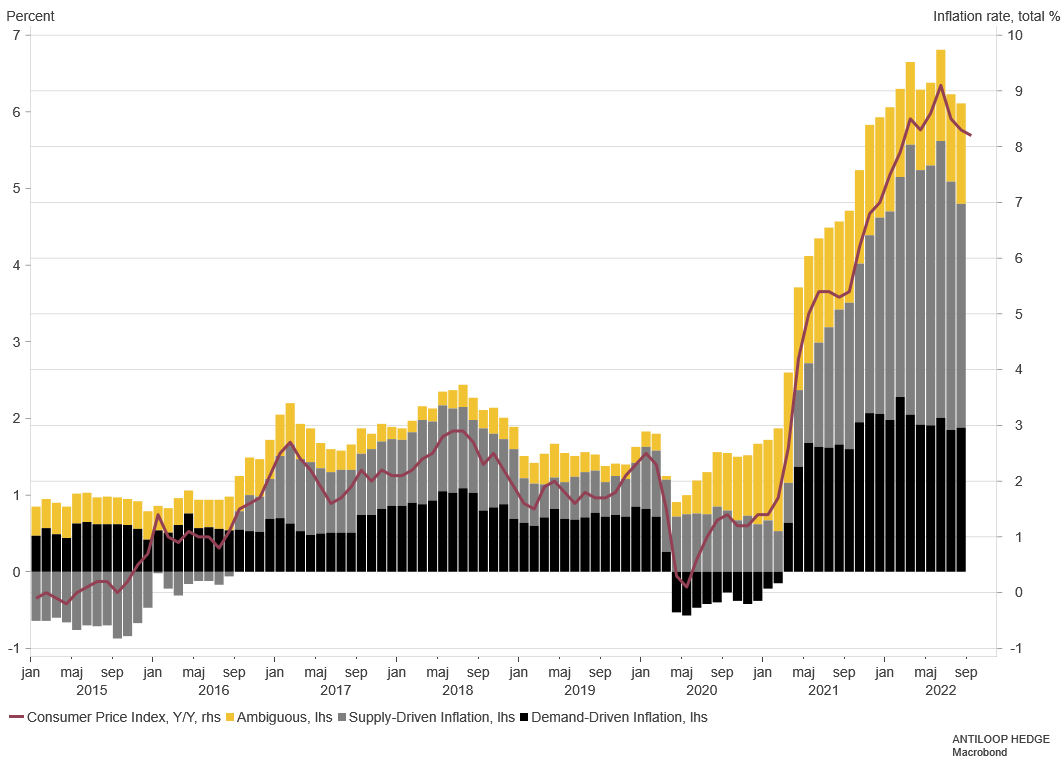

I will now say something I have never said before. I believe inflation is on its way down. Not permanently, and not to “old normal” levels, but still lower than today. There are few factors that would signal that inflation would continue to move upwards. The post-covid supply chain crisis is long gone, freight prices are falling and the global food index has come down almost 15 percent since its peak in March. But, most importantly, the Federal Reserve’s rate hikes and falling asset prices as well as lagging wages have with no doubt had a huge effect on consumer confidence and hence demand driven inflation.

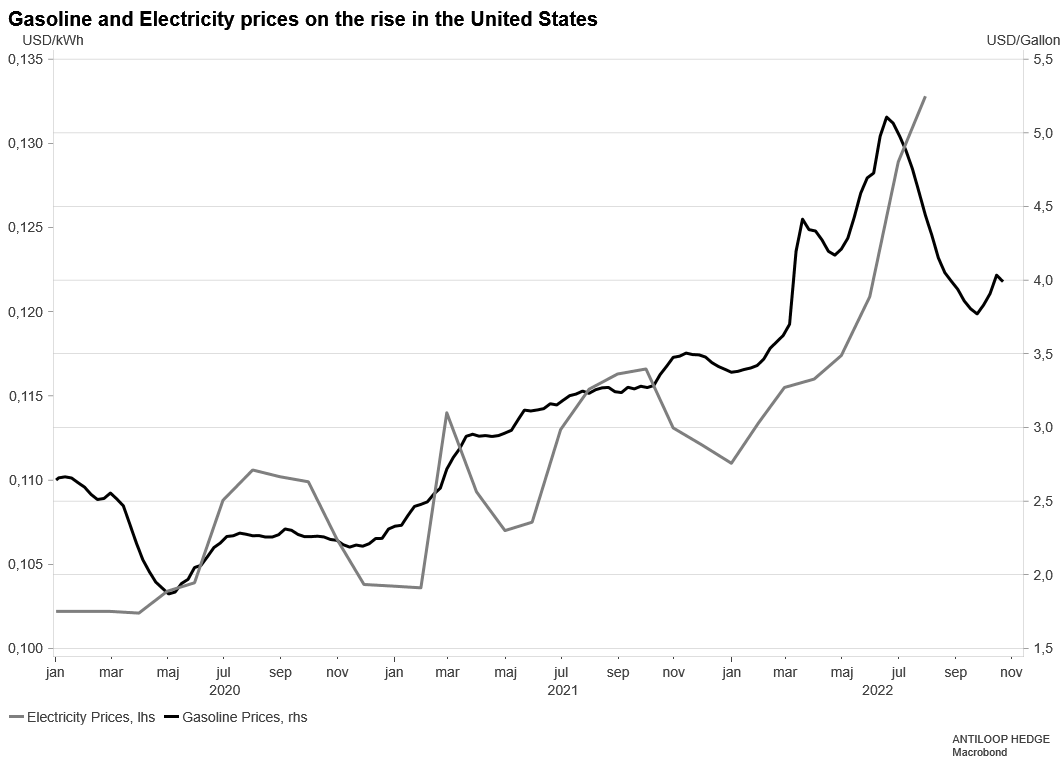

In summary, what I’m saying is, that a recession around the corner will make the inflation problem look contained, but not forever. While European electricity and gas prices have come crashing down these last few weeks we still lack a solution to the problem of 2023. When the whole Eurozone decided to fill up gas storage simultaneously it pushed prices to record levels. When the flow later stopped, prices fell back again.

However, in the US, electricity prices are still moving upwards, as well as gasoline prices after a 25 percent downturn between mid June and end of September. Since then, gasoline prices have once again climbed around 6 percent and, in October so far, gasoline prices are up over 17 percent on a year on year basis. This means, that while the inflation pressure from energy prices seems to cool down in Europe, we are yet to see the same effect in the United States.

In the coming months, we should see CPI printing slightly lower, something I expect will lead to another rally in equities as investors will cling to the hope of a Fed pivot. If, and only if, the Federal Reserve would be forced to pivot, it would only be because the economy is so broken, that they can not possibly keep their tightening cycle. But, what I can’t seem to wrap my head around is, as macro superstar Alfonso Peccatiello put it in the podcast The Macro Trading Floor “what is so bullish about a recession?”.

In the coming months, we should see CPI printing slightly lower, something I expect will lead to another rally in equities as investors will cling to the hope of a Fed pivot. If, and only if, the Federal Reserve would be forced to pivot, it would only be because the economy is so broken, that they can not possibly keep their tightening cycle. But, what I can’t seem to wrap my head around is, as macro superstar Alfonso Peccatiello put it in the podcast The Macro Trading Floor “what is so bullish about a recession?”.

Pain is needed until it hurts.

Powell has been steadfast in his opinion that pain is needed to bring inflation down, but investors still don’t seem to take him seriously as we are yet to see capitulation in equities. Alan Blinder, former Fed vice chair, said in an interview with The New York Times in mid-October that he expects the Federal Reserve to do another 75bp hike in November as the alternative would be to hike 50bp and say “we’ve seen progress on inflation”, when in fact more data suggests higher prices are stickier than first anticipated.

The fantasy of a soft landing is long gone, and the IMF recently warned that one-third of the global economy might tip into contraction next year as the world is simultaneously fighting the highest inflation in decades while trying to handle the damage from the war in Ukraine and the consequences of the economic slowdown in China.

Overall, it is not a pretty outlook.